Data Driven Investing (with Excel®) | Financial Data Science

Genre: eLearning | MP4 | Video: h264, 1280x720 | Audio: AAC, 44.1 KHz

Language: English | Size: 5.59 GB | Duration: 13h 10m

Become a Data Driven Investor. Rigorously Test & Statistically Validate Investments From Scratch | Quantitative Finance

What you'll learn

Remove the "guesswork" from your investing forever by learning how to statistically test and validate your investment ideas rigorously

Discover and master the systematic and scientific Data Driven Investing process that will transform the way you analyse investments forever

Apply everything you learn using rich, large real world data (without compromising on the mathematical and theoretical integrity of concepts)

Learn how to leverage incredibly powerful relationships and rigorous financial data science techniques to generate Alpha (seriously)

Understand why the math works (and why equations work the way they do) - even if your math is weak and if math freaks you out.

Explore evergreen concepts like Expected Returns, Asset Pricing Models, and Portfolio Construction in unique Financial Data Science settings

Learn and apply powerful Quantitative Finance techniques including "sorts" to create and design portfolios, regressions to "test for alpha", and much more

Discover how to quantify risk and measure returns of individual stocks and investment portfolios, both manually as well as on Excel working with real-world data

Description

Become a Data Driven Investor. Take the guesswork out of your investing forever. Leverage the power of Financial Data Science, Financial Analysis, and Quantitative Finance to make robust investment decisions (and generate Alpha).

Discover how to use rigorous statistical techniques to guide your investment decisions (even if you don't know statistics or your math is weak).

Say hello to the most comprehensive Data Driven Investing course on the internet. Featuring:

# =============================

# 2 PARTS, 8 SECTIONS TO MASTERY

# =============================

(plus, all future updates included!)

Structured learning path, Designed for Distinction™ including:

13 hours of engaging, practical, on-demand HD video lessons

Real-world applications throughout the course

200+ quiz questions with impeccably detailed solutions to help you stay on track and retain your knowledge

Assignments that take you outside your comfort zone and empower you to apply everything you learn

A Practice Test to hone in and gain confidence in the core evergreen fundamentals

Excel® spreadsheets/templates (built from scratch) to help you build a replicable system for investing

Mathematical proofs for the mathematically curious

An instructor who's insanely passionate about Finance, Investing, and Financial Data Science

PART I: INVESTMENT ANALYSIS FUNDAMENTALS

Start by gaining a solid command of the core fundamentals that drive the entire investment analysis / financial analysis process.

Explore Investment Security Relationships & Estimate Returns

Discover powerful relationships between Price, Risk, and Returns

Intuitively explore the baseline fundamental law of Financial Analysis - The Law of One Price.

Learn what "Shorting" a stock actually means and how it works

Learn how to calculate stock returns and portfolio returns from scratch

Download and work with real-world data on Excel® for any stock(s) you want, anywhere in the world

Estimate Expected Returns of Financial Securities

Explore what "expected returns" are and how to estimate them starting with the simple mean

Dive deeper with "state contingent" expected returns that synthesise your opinions with the data

Learn how to calculate expected returns using Asset Pricing Models like the CAPM (Capital Asset Pricing Model)

Discover Multi Factor Asset Pricing Models including the "Fama French 3 Factor Model", Carhart 4 ("Momentum"), and more)

Master the theoretical foundation and apply what you learn using real-world data on your own!

Quantify Stock Risk and Estimate Portfolio Risk

Examine the risk of a stock and learn how to quantify total risk from scratch

Apply your knowledge to any stock you want to explore and work with

Discover the 3 factors that influence portfolio risk (1 of which is more important than the other two combined)

Explore how to estimate portfolio risk for 'simple' 2-asset portfolios

Learn how to measure portfolio risk of multiple stocks (including working with real-world data!)

Check your Mastery

So. Much. Knowledge, Skills, and Experience. Are you up for the challenge? - Take the "Test Towards Mastery"

Identify areas you need to improve on and get better at in the context of Financial Analysis / Investment Analysis

Set yourself up for success in Financial Data Science / Quantitative Finance by ensuring you have a rigorous foundation in place

PART II: DATA DRIVEN INVESTING | FINANCIAL DATA SCIENCE / QUANTITATIVE FINANCE

Skyrocket your financial analysis / investment analysis skills to a whole new level by learning how to leverage Financial Data Science and Quantitative Finance for your investing.

Discover Data Driven Investing and Hypothesis Design

Discover what "data driven investing" actually is, and what it entails

Explore the 5 Step Data Driven Investing process that's designed to help you take the guesswork out of your investment decision making

Learn how to develop investment ideas (including how/where to source them from)

Explore the intricacies of "research questions" in the context of Financial Data Science / Data Driven Investing

Transform your investment ideas into testable hypotheses (even if you don't know what a "testable hypothesis" is)

Collect, Clean, and Explore Real-World Data

Explore how and where you can source data to test and validate your own hypotheses

Master the backbone of financial data science - data cleaning - and avoid the "GIGO" trap (even if you don't know what "GIGO" is)

Work with large datasets (arguably "Big Data") with over 1.4 million observations using Excel®!

Discover quick "hacks" to easily extract large amounts of data semi-automatically on Google Sheets

Learn while exploring meaningful questions on the impact of ESG in financial markets

Conduct Exploratory Data Analysis

Discover how to conduct one of the most common financial data science techniques - "exploratory data analysis" using Excel®!

Evaluate intriguing relationships between returns and ESG (or another factor of your choice)

Learn how to statistically test and validate hypotheses using 'simple' t-tests

Never compromise on the mathematical integrity of the concepts - understand why equations work the way they do

Explore how to "update" beliefs and avoid losing money by leveraging the power of financial data science and quantitative finance

Design and Construct Investment Portfolios

Explore exactly what it takes to design and construct investment portfolios that are based on individual investment ideas

Learn how to sort firms into "buckets" to help identify monotonic relationships (a vital analysis technique of financial data science)

Discover intricate "hacks" to speed up your workflow when working with large datasets on Excel

Strengthen your financial data science skills by becoming aware of Excel®'s "bugs" (and what you can do to overcome them)

Plot charts that drive meaningful insights for Quantitative Finance, including exploring portfolio performance over time

Statistically Test and Validate Hypotheses

Say goodbye to guesswork, hope, and luck when it comes to making investment decisions

Rigorously test and statistically validate your investment ideas by applying robust financial data science techniques

Add the use of sophisticated tools including simple t-stats and more 'complex' regressions to your suite of financial data science analytics

Explore what it really takes to search for and generate Alpha (to "beat the market")

Learn and apply tried and tested financial data science and quantitative finance techniques used by hedge funds, financial data scientists, and researchers

DESIGNED FOR DISTINCTION™

We've used the same tried and tested, proven to work teaching techniques that have helped our clients ace their professional exams (e.g., ACA, ACCA, CFA®, CIMA), get hired by the most renowned investment banks in the world, manage their own portfolios, take control of their finances, get past their fear of math and equations, and so much more.

You're in good hands.

Here's how we'll help you master incredibly powerful Financial Data Science & Financial Analysis techniques to become a robust data driven investor...

A Solid Foundation

You’ll gain a solid foundation of the core fundamentals that drive the entire financial analysis / investment analysis process. These fundamentals are the essence of financial analysis done right.

And they'll hold you in mighty good stead both when you start applying financial data science techniques in Part II of this course, but also long after you've completed this course. Top skills in quantitative finance - for the rest of your life.

Practical Walkthroughs

Forget about watching videos where all the Excel® templates are pre-built. We'll start from blank Excel® spreadsheets (like the real world).

And we'll build everything from scratch, one cell at a time. That way you'll literally see how we conduct rigorous financial analysis / financial data science using data-driven investing as the core basis, one step at a time.

Hundreds of Quiz Questions, Dozen Assignments, and Much More

Apply what you learn immediately with 200+ quiz questions, all with impeccably detailed solutions. Plus, over a dozen assignments that take you outside your comfort zone. There's also a Practice Test to help you truly hone your knowledge and skills. And boatloads of practical, hands-on walkthroughs where we apply financial data science / quantitative finance techniques in data driven investing environments.

Proofs & Resources

Mathematical proofs for the mathematically curious. And also because, what's a quantitative finance course without proofs?!

Step-by-step mathematical proofs, workable and reusable Excel® spreadsheets, variable cheat sheets – all included. Seriously.

This is the only course you need to genuinely master Data Driven Investing, and apply Financial Data Science & Quantitative Finance techniques without compromising on the theoretical integrity of concepts.

Who this course is for:

Individual / retail investors looking to "up" their Financial Analysis game by leveraging the power of Financial Data Science

Hedge Funds Analysts and Associates looking to master Long-Short / Asset Pricing style Quantitative Finance techniques

Portfolio Managers wanting to move away from subjective decision making to robust data-driven investment analysis techniques grounded in the academic and practitioner research

CFA®, ACA, ACCA students looking to apply familiar concepts in practical, data-driven / financial data science environments

Current and prospective Analysts and Investment Bankers wanting to gain a solid foundation in data driven investment analysis

Anyone who's curious about learning and applying Financial Data Science using familiar tools like Excel®

DJordanMedia The Complete Editing Course Bundle Pack

2025-11-11 23:09:34

Luke Stackpoole – Photography Masterclass – Master The Art Of Photography

2025-11-11 18:14:10

77组电影外观Log/Rec709视频还原色彩分级调色Lut预设包Pixflow – Colorify Cinematic LUTs

2025-02-13 11:03:14

复古怀旧电影风格温暖色调索尼Sony S-Log3视频调色LUT预设ROMAN HENSE – LUTs 24 for Sony S-Log3

2025-02-13 11:01:09

JUAN MELARA – P6K2Alexa PowerGrade AND LUTs V2 GEN 5

2025-02-13 10:58:24

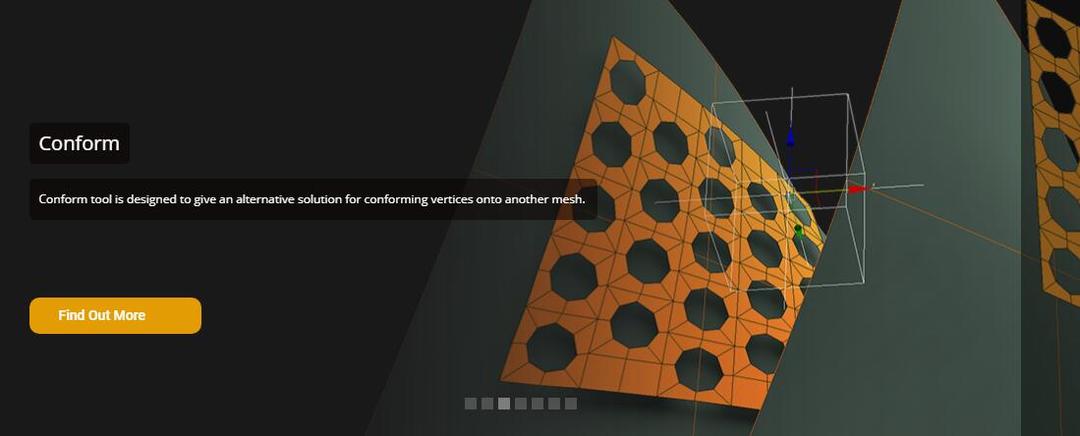

3DsMax建模插件集合:rapidTools v1.14+使用教程

2020-07-06 17:44:38

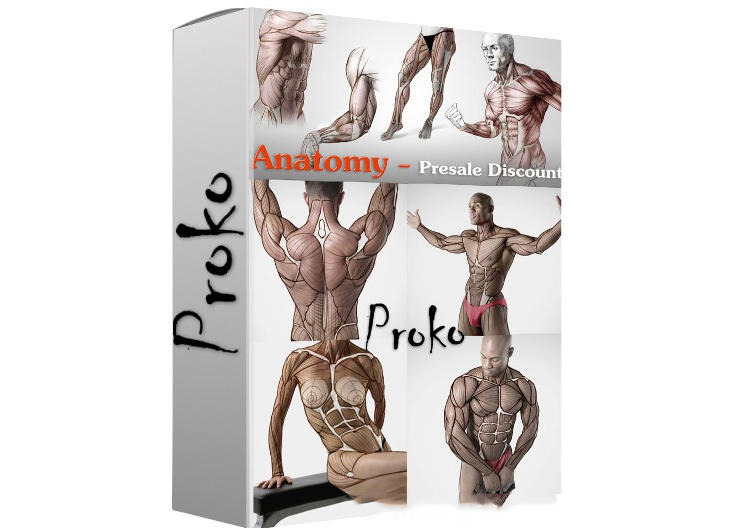

Proko-人体解剖高级付费版(中文字幕)256课

2020-12-21 18:34:01

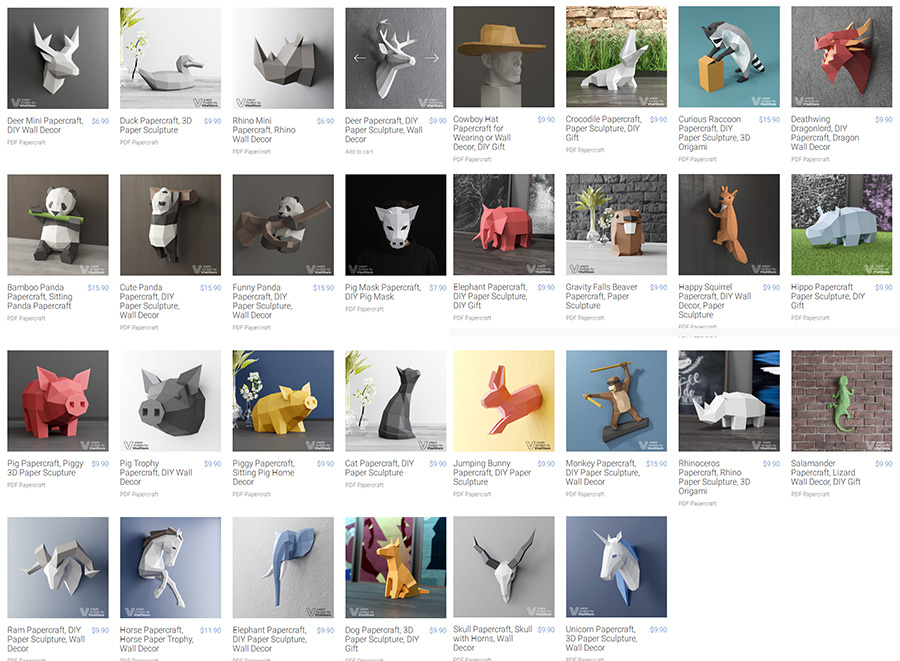

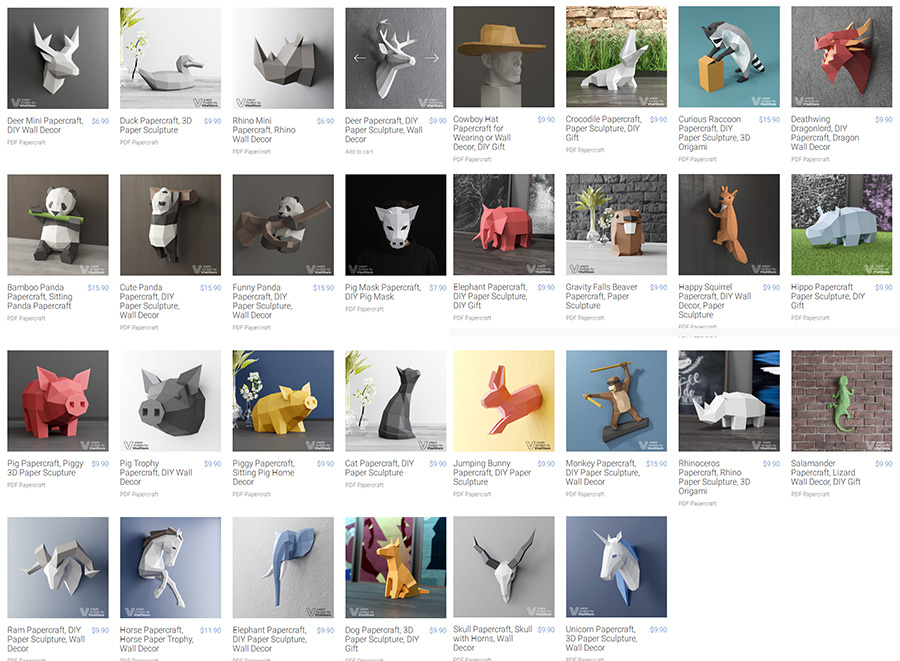

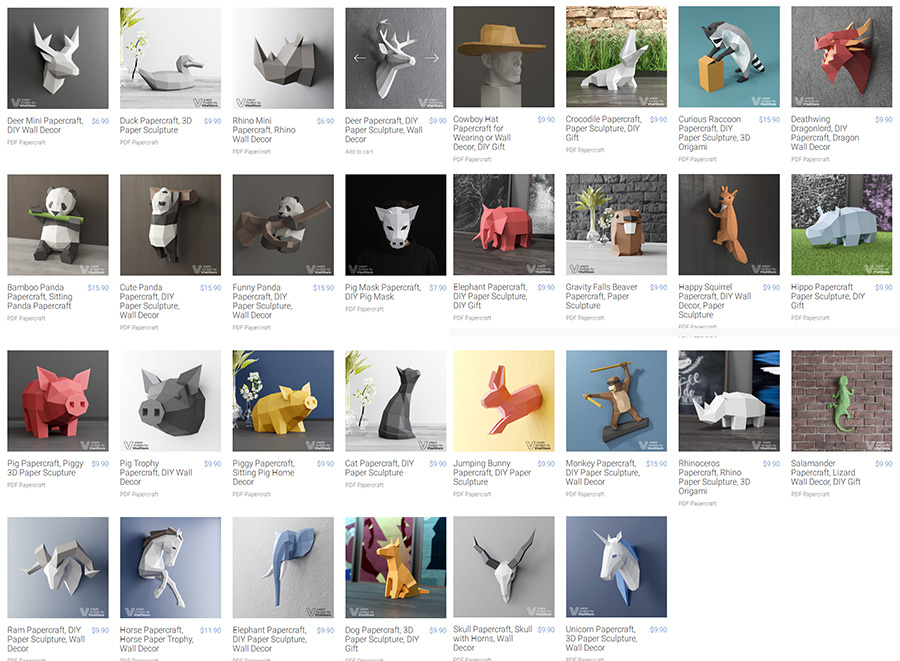

VitaliStore - All Design Bundle Papercraft Sculptures Design 动物纸模模型 纸模型雕塑设计

2020-07-21 17:18:14

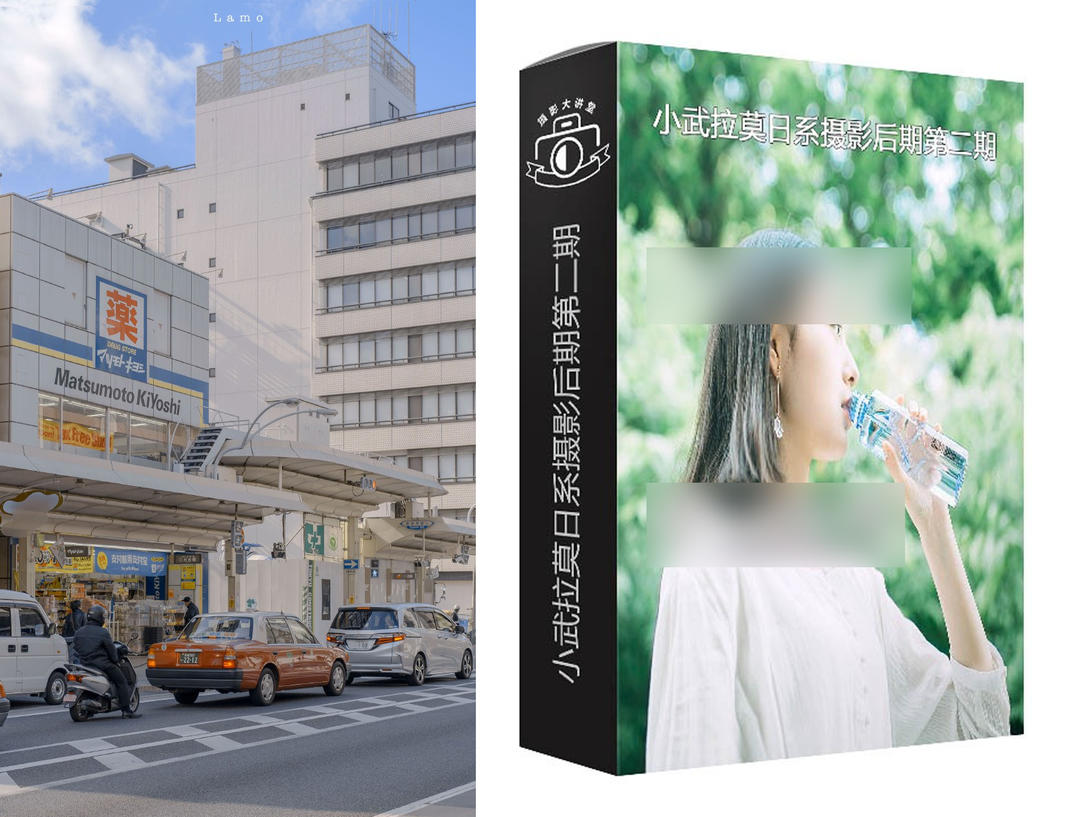

小武拉莫日系摄影后期第二期中文视频教程

2021-12-10 14:26:14

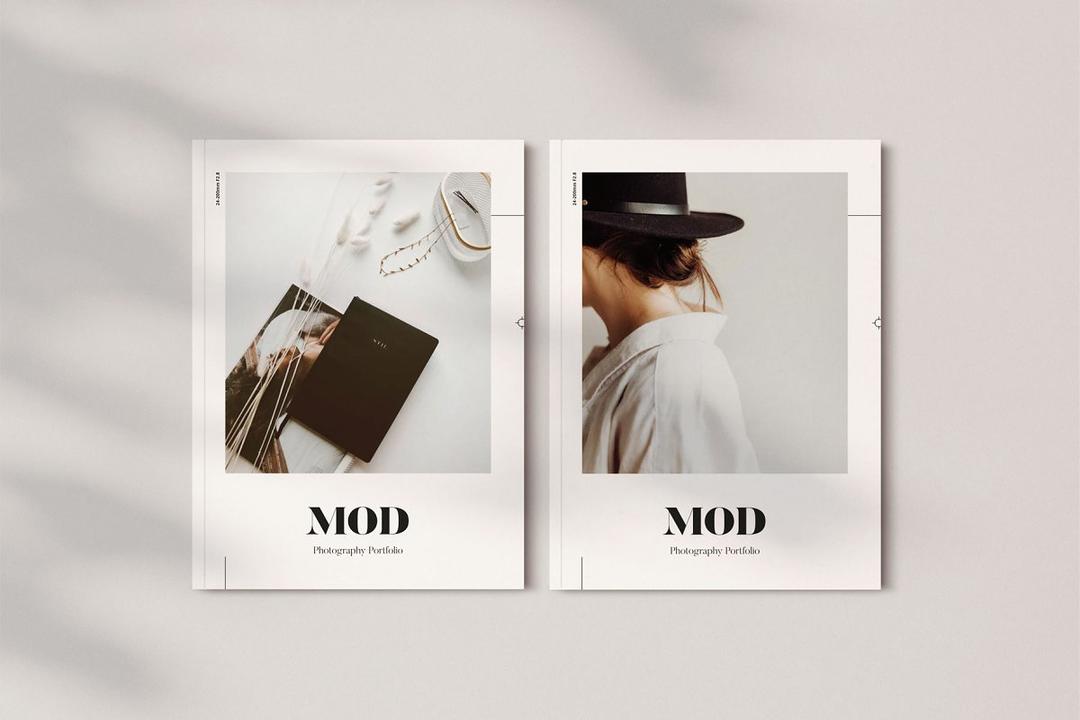

Mod Portfolio 3477506 画册模板 时尚杂志画册模版

2020-07-13 10:43:06

小武拉莫日系摄影后期第二期中文视频教程

2021-12-10 14:26:14

VitaliStore - All Design Bundle Papercraft Sculptures Design 动物纸模模型 纸模型雕塑设计

2020-07-21 17:18:14

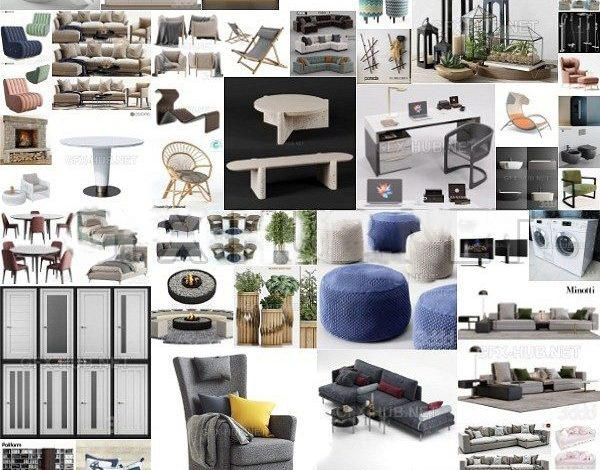

3DDD 3DSky PRO models – April 2021

2021-08-09 17:15:13

MasterClass 大师班课程84套合集+中文字幕+持续更新+赠品会员

2021-01-26 16:03:27

加特林机枪模型 加特林机关枪 Minigun Hi-Poly

2019-07-31 11:06:07

评论(0)