资源信息 | Information

资源信息 | Information芝加哥大学资产定价Coursera WEBRIP |英文| MP4 + PDF指南| 960 x 540 | AVC〜253 kbps | 25 fps AAC | 98.9 Kbps | 48.0 KHz | 2个频道| Subs:英文(.srt)| 15:18:52 | 2.48 GB 类型:电子学习视频/经济与金融 你对定量学术金融好奇吗?你是否考虑过金融研究生课程?你在投资银行,资金管理公司或对冲基金中工作,想更好地了解模型?你想知道beta,风险溢价,风险中性价格,套利和贴现因素的流行语意味着什么?这个班是给你的 我们将看到一个基本思想,价格等于预期贴现收益,统一一切 - 描述股票,债券,期权,实际投资,离散时间,连续时间,资产定价,投资组合理论等的模型。 我们将从基本的基于消费的模型开始,我们将预览金融中的经典问题。我们会在简单的经济均衡中考虑资产定价。然后,我们将退后一步,研究或有债权和定理,显示折现因子的存在(p = E(mx))。我们将探讨均值方差边界和预期收益率与β模型和因子结构。以下简要介绍当前的事实和难题。然后,去学习选项和Black-Scholes公式,债券定价模型和事实。我们将用现代投资组合理论来关闭。 实际的金融数学并不是那么难。了解如何使用方程式,看看他们真正意义上的世界...这很难,这就是我希望对这个课程有独到的回报。 教学大纲 第1部分教学大纲: 第1周:随机微积分介绍与回顾。 dz,dt等等。 第2周:简介和概述。有挑战性的事实和基本消费模式。 第3周: 金融经典问题 平衡,或有债权,风险中性概率。 第四周:国家空间代表,风险分担,汇总,存在折扣因子。 第5周:平均差异边界,Beta表示,调节信息。 第6周:因子定价模型 - CAPM,ICAPM和APT。 第7周:资产定价和GMM的计量经济学。 期末考试 第2部分是一个单独的课程,可以单独从第1部分开始。这里是你的胃口的教学大纲: 春假(1周) 第1周:行动中的因素定价模式 Fama和法国模特儿 基金和业绩评估。 第2周:时间序列的可预测性,挥发性和气泡。 第三周:股权溢价,宏观经济和资产定价。 第4周:期权定价。 第5周:期限结构模型和事实。 第六周:投资组合理论。 期末考试 你也可以看另外最后一个: Coursera短柱 的MediaInfo: 一般 完整名称:02_2._Understanding_P__EMx_13-11.mp4 格式:MPEG-4 格式配置文件:基本介质 编解码器ID:isom 文件大小:33.8 MiB 时间:13mn 11s 总比特率模式:变量 总比特率:358 Kbps 编码日期:UTC 1970-01-01 00:00:00 标签日期:UTC 1970-01-01 00:00:00 写作应用:Lavf52.99.1 视频 ID:1 格式:AVC 格式/信息:高级视频编解码器 格式配置文件:High @ L3 格式设置,CABAC:是 格式设置,ReFrames:4帧 编解码器ID:avc1 编解码器ID /信息:高级视频编码 时间:13mn 11s 比特率:253 Kbps 宽度:960像素 身高:540像素 显示宽高比:16:9 帧率模式:常数 帧速率:25.000 fps 颜色空间:YUV 色度子采样:4:2:0 位深度:8位 扫描类型:渐进式 位/(像素*帧):0.020 流量:23.9 MiB(71%) 写作库:x264 core 114 r1913 5fd3dce 编码设置:cabac = 1 / ref = 1 / deblock = 1:0:0 / analyze = 0x3:0x113 / me = hex / subme = 2 / psy = 1 / psy_rd = 0.00:0.00 / mixed_ref = 0 / me_range = 16 / chroma_me = 1 / trellis = 0 / 8x8dct = 1 / cqm = 0 / deadzone = 21,11 / fast_pskip = 1 / chroma_qp_offset = 0 / threads = 3 / sliced_threads = 0 / nr = 0 / decimate = 1 / interlaced = 0 / constrained_intra = 0 / bframes = 3 / b_pyramid = 2 / b_adapt = 1 / b_bias = 0 / direct = 1 / weightb = 1 / open_gop = 0 / weightp = 0 / keyint = 250 / keyint_min = 25 / scenecut = 40 / intra_refresh = 0 / rc_lookahead = 10 / rc = crf / mbtree = 1 / crf = 28.0 / qcomp = 0.60 / qpmin = 0 / qpmax = 69 / qpstep = 4 / ip_ratio = 1.41 / aq = 1:1.00 英语语言 编码日期:UTC 1970-01-01 00:00:00 标签日期:UTC 1970-01-01 00:00:00 音频 ID:2 格式:AAC 格式/信息:高级音频编解码器 格式资料:LC 编码编号:40 时间:13mn 11s 比特率模式:可变 比特率:98.9 Kbps 频道:2个频道 通道位置:前方:L R 采样率:48.0KHz 压缩模式:有损 商业 流大小:9.33 MiB(28%) 英语语言 编码日期:UTC 1970-01-01 00:00:00 标签日期:UTC 1970-01-01 00:00:00 截图 独家 Ë 学习视频 ParRus-博客 ← 添加到书签

Coursera - Asset Pricing, The University of Chicago WEBRip | English | MP4 + PDF Guides | 960 x 540 | AVC ~253 kbps | 25 fps AAC | 98.9 Kbps | 48.0 KHz | 2 channels | Subs: English (.srt) | 15:18:52 | 2.48 GB Genre: eLearning Video / Economics and Finance Are you curious about quantitative academic finance? Have you considered graduate study in finance? Are you working in an investment bank, money-management firm or hedge fund and you want to understand models better? Would you like to know what buzzwords like beta, risk premium, risk-neutral price, arbitrage, and discount factor mean? This class is for you. We will see how one basic idea, price equals expected discounted payoff, unites everything - models that describe stocks, bonds, options, real investments, discrete time, continuous time, asset pricing, portfolio theory, and so forth. We'll start with the underlying consumption-based model, and we’ll preview the classic issues in finance. We’ll think about asset pricing in a simple economic equilibrium. Then, we'll take a step back and study contingent claims and the theorems showing the existence of a discount factor (the m in p=E(mx)). We'll explore the mean-variance frontier and expected return vs. beta models and factor structures. A brief tour of current facts and puzzles follows. Then, off to study options and the Black-Scholes formula, bond pricing models and facts. We will close with modern portfolio theory. The math in real finance is not actually that hard. Understanding how to use the equations, and see what they really mean about the world… that's hard, and that's what I hope will be uniquely rewarding about this class. Syllabus Part 1 syllabus: Week 1: Stochastic Calculus Introduction and Review. dz, dt and all that. Week 2: Introduction and Overview. Challenging Facts and Basic Consumption-Based Model. Week 3: Classic issues in Finance Equilibrium, Contingent Claims, Risk-Neutral Probabilities. Week 4: State-Space Representation, Risk Sharing, Aggregation, Existence of a Discount Factor. Week 5: Mean-Variance Frontier, Beta Representations, Conditioning Information. Week 6: Factor Pricing Models – CAPM, ICAPM and APT. Week 7: Econometrics of Asset Pricing and GMM. Final Exam Part 2 is a separate course, which may be taken separately from Part 1. Here is the syllabus to whet your appetite: Spring break (1 week) Week 1: Factor pricing models in action The Fama and French model Fund and performance evaluation. Week 2: Time series predictability, volatilty and bubbles. Week 3: Equity premium, macroeconomics and asset pricing. Week 4: Option Pricing. Week 5: Term structure models and facts. Week 6: Portfolio Theory. Final Exam also You can watch my other last: Coursera-posts MediaInfo: General Complete name : 02_2._Understanding_P__EMx_13-11.mp4 Format : MPEG-4 Format profile : Base Media Codec ID : isom File size : 33.8 MiB Duration : 13mn 11s Overall bit rate mode : Variable Overall bit rate : 358 Kbps Encoded date : UTC 1970-01-01 00:00:00 Tagged date : UTC 1970-01-01 00:00:00 Writing application : Lavf52.99.1 Video ID : 1 Format : AVC Format/Info : Advanced Video Codec Format profile : High@L3 Format settings, CABAC : Yes Format settings, ReFrames : 4 frames Codec ID : avc1 Codec ID/Info : Advanced Video Coding Duration : 13mn 11s Bit rate : 253 Kbps Width : 960 pixels Height : 540 pixels Display aspect ratio : 16:9 Frame rate mode : Constant Frame rate : 25.000 fps Color space : YUV Chroma subsampling : 4:2:0 Bit depth : 8 bits Scan type : Progressive Bits/(Pixel*Frame) : 0.020 Stream size : 23.9 MiB (71%) Writing library : x264 core 114 r1913 5fd3dce Encoding settings : cabac=1 / ref=1 / deblock=1:0:0 / analyse=0x3:0x113 / me=hex / subme=2 / psy=1 / psy_rd=0.00:0.00 / mixed_ref=0 / me_range=16 / chroma_me=1 / trellis=0 / 8x8dct=1 / cqm=0 / deadzone=21,11 / fast_pskip=1 / chroma_qp_offset=0 / threads=3 / sliced_threads=0 / nr=0 / decimate=1 / interlaced=0 / constrained_intra=0 / bframes=3 / b_pyramid=2 / b_adapt=1 / b_bias=0 / direct=1 / weightb=1 / open_gop=0 / weightp=0 / keyint=250 / keyint_min=25 / scenecut=40 / intra_refresh=0 / rc_lookahead=10 / rc=crf / mbtree=1 / crf=28.0 / qcomp=0.60 / qpmin=0 / qpmax=69 / qpstep=4 / ip_ratio=1.41 / aq=1:1.00 Language : English Encoded date : UTC 1970-01-01 00:00:00 Tagged date : UTC 1970-01-01 00:00:00 Audio ID : 2 Format : AAC Format/Info : Advanced Audio Codec Format profile : LC Codec ID : 40 Duration : 13mn 11s Bit rate mode : Variable Bit rate : 98.9 Kbps Channel(s) : 2 channels Channel positions : Front: L R Sampling rate : 48.0 KHz Compression mode : Lossy Business Stream size : 9.33 MiB (28%) Language : English Encoded date : UTC 1970-01-01 00:00:00 Tagged date : UTC 1970-01-01 00:00:00 Screenshots Exclusive e Learning Videos ParRus-blog ← add to bookmarks

DJordanMedia The Complete Editing Course Bundle Pack

2025-11-11 23:09:34

Luke Stackpoole – Photography Masterclass – Master The Art Of Photography

2025-11-11 18:14:10

77组电影外观Log/Rec709视频还原色彩分级调色Lut预设包Pixflow – Colorify Cinematic LUTs

2025-02-13 11:03:14

复古怀旧电影风格温暖色调索尼Sony S-Log3视频调色LUT预设ROMAN HENSE – LUTs 24 for Sony S-Log3

2025-02-13 11:01:09

JUAN MELARA – P6K2Alexa PowerGrade AND LUTs V2 GEN 5

2025-02-13 10:58:24

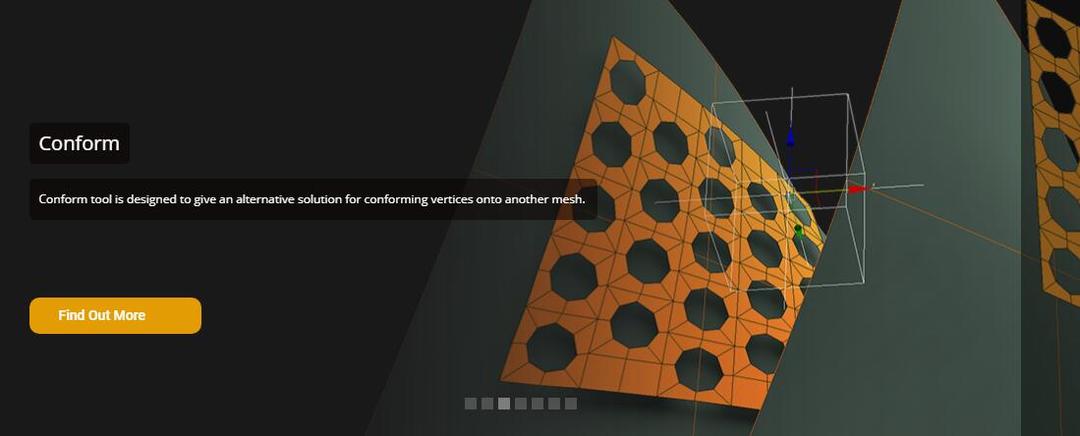

3DsMax建模插件集合:rapidTools v1.14+使用教程

2020-07-06 17:44:38

Proko-人体解剖高级付费版(中文字幕)256课

2020-12-21 18:34:01

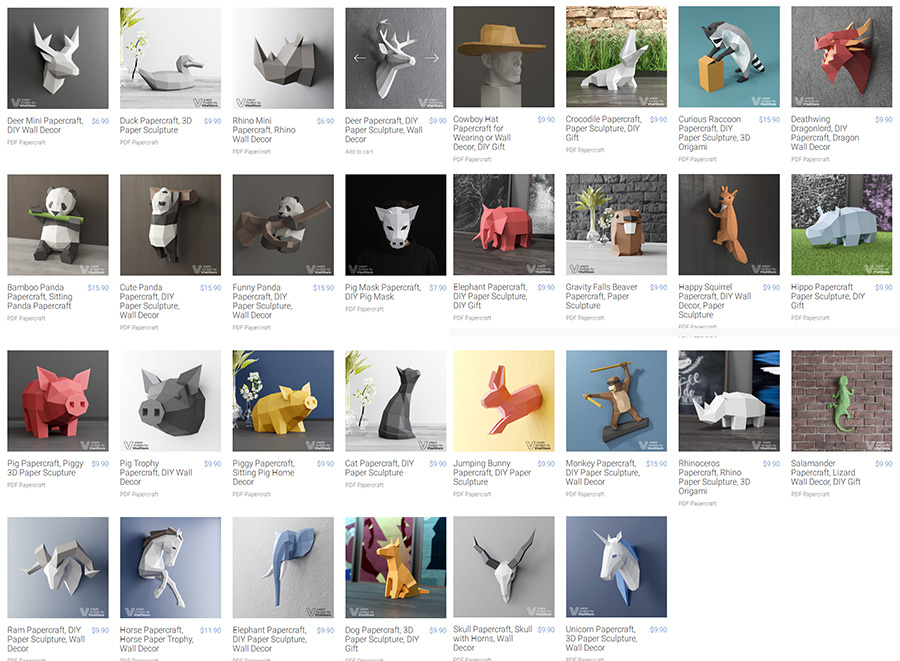

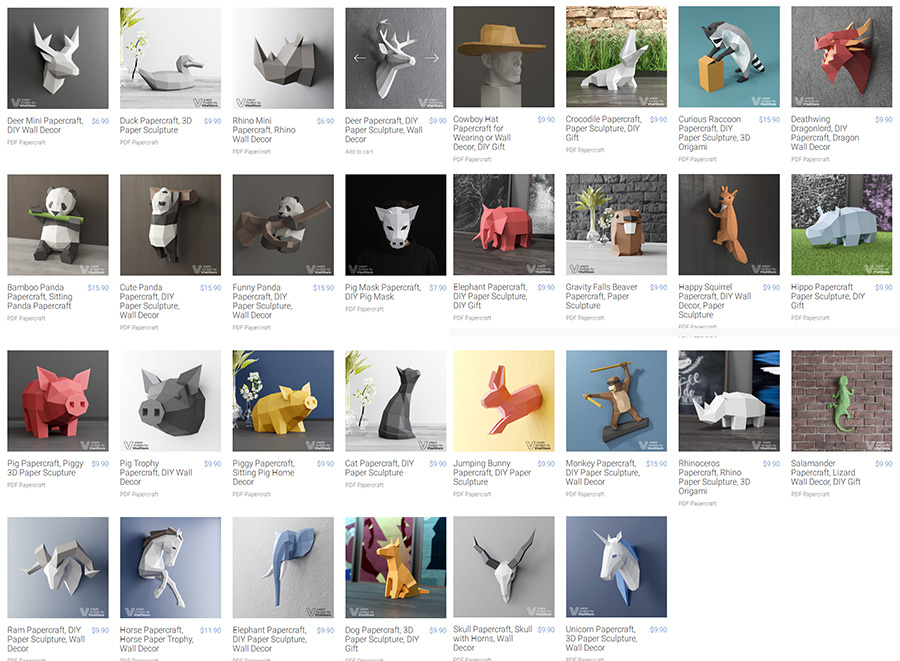

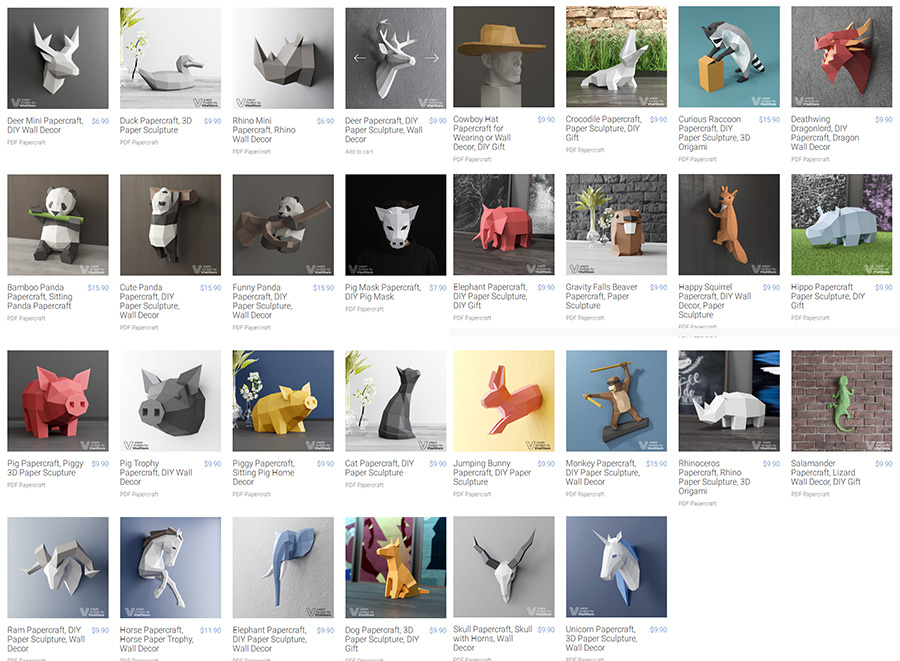

VitaliStore - All Design Bundle Papercraft Sculptures Design 动物纸模模型 纸模型雕塑设计

2020-07-21 17:18:14

小武拉莫日系摄影后期第二期中文视频教程

2021-12-10 14:26:14

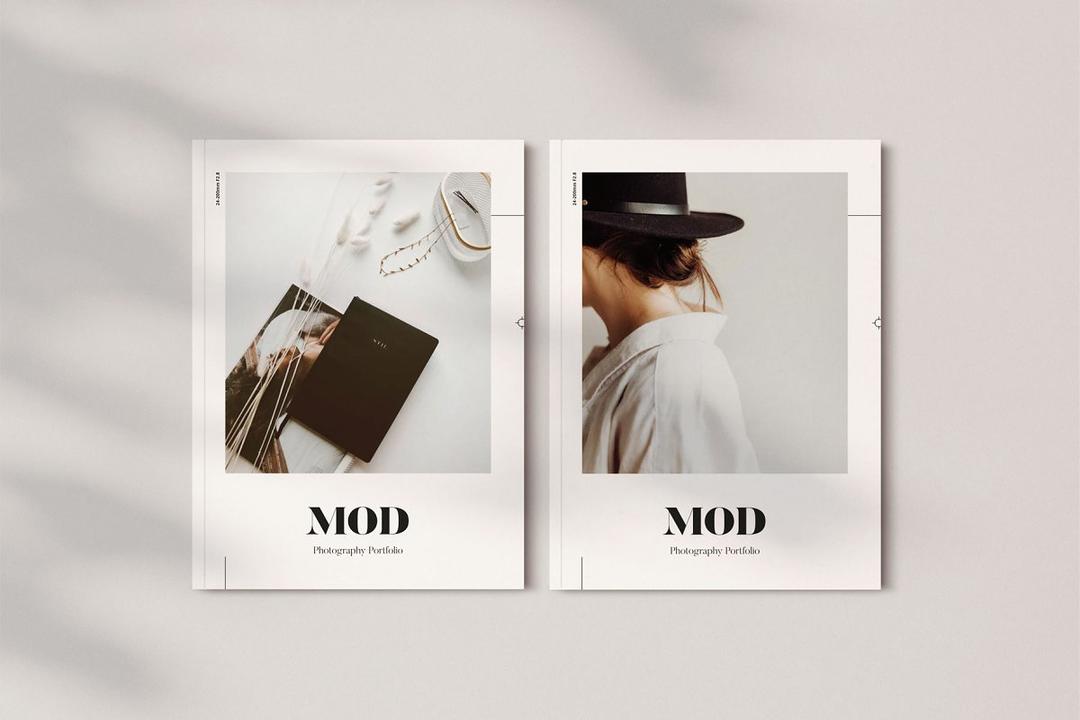

Mod Portfolio 3477506 画册模板 时尚杂志画册模版

2020-07-13 10:43:06

小武拉莫日系摄影后期第二期中文视频教程

2021-12-10 14:26:14

VitaliStore - All Design Bundle Papercraft Sculptures Design 动物纸模模型 纸模型雕塑设计

2020-07-21 17:18:14

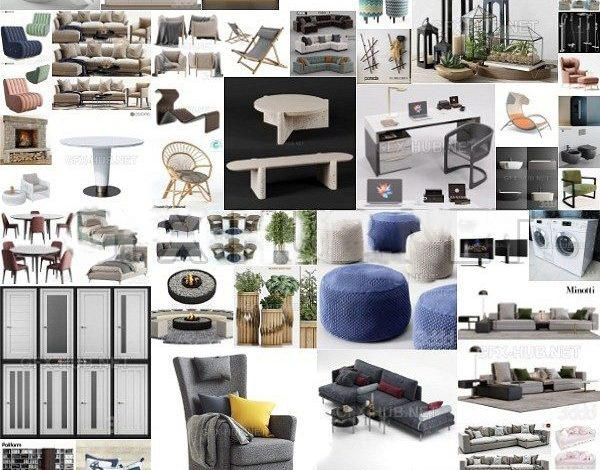

3DDD 3DSky PRO models – April 2021

2021-08-09 17:15:13

MasterClass 大师班课程84套合集+中文字幕+持续更新+赠品会员

2021-01-26 16:03:27

加特林机枪模型 加特林机关枪 Minigun Hi-Poly

2019-07-31 11:06:07

评论(0)