Learn Financial Modeling in Excel that will allow you to participate in due diligence, strategy or turn around projects

What is the aim of this course?

As a business analysts or a consultant you will have to from time to time create financial models. There are a bit different than business models. In business models you go into details of operations and you focus on getting the links on the KPIs. Those models are usually done for internal purposes, to manage in the right direction the business. Financial models on the other hand are more for external users. You concentrate in them on creating the picture of the business in a standardized, understood by everybody way. You also want to create the financial statements: profit & loss statement, balance sheet statement, cash flow statement.

On top of that you use the financial statements for valuation purposes.

The most typical situation when, as a business analyst or a consultant, you will have to prepare such a model are connected with selling or purchasing a company. You may be doing it on the sell side or on the buy side. Financial modeling is done as a part of strategy projects, turn around projects, due diligence.

I will NOT teach you everything on financial modelling because it is simply not efficient (and frankly you don’t need it). This course is organized around 80/20 rule and I want to teach you the most useful (from business analyst / consultant perspective) ways to go as fast as possible from rough description to working model in Excel that you can make more and more complicated.

The aim of this course is that you are able to do a financial model of the business as fast as possible.

If done properly, this course will transform you in 1 day into pretty good business analyst that knows how to create fast and efficiently financial models. It is based on my 12 years of experience as a consultant in top consulting companies and as a Board Member responsible for strategy, improvement and turn-arounds in biggest companies from FMCG, SMG, B2B sector that I worked for. On the basis of what you will find in this course I have trained over 100 business analysts who now are Investment Directors, Senior Analyst, Directors in Consulting Companies, Board Members etc.

I teach step by step on the basis of Excel files that will be attached to the course. We will go through a real life example of a business and create the financial model for it. To make the best out of the course you should follow my steps and repeat what I do with the data after every lecture. Don’t move to the next lecture if you have not done what I show in the lecture that you have gone through.

I assume that you know basic Excel so the basic features (i.e. how to write formula in Excel) are not explained in this course. I concentrate on intermediate and advanced solutions and purposefully get rid of some things that are advanced yet later become very inflexible and useless (i.e. naming the variables).

To every lecture you will find attached (in additional resources) the Excel shown in the Llcture so as a part of this course you will also get a library of ready-made analyses that can, with certain modification, be applied by you in your work.

Why I decided to create this course?

This course is a part of my attempt to help business analyst and consultants gain fast useful knowledge that will help them excel at their work. I have done 10 other courses that will help you be great business analysts or consultants. I have covered already: hacks and tricks in Excel, business modelling, market research, management productivity hacks and others. Now you have the opportunity to learn financial modeling in Excel

In what way will you benefit from this course?

The course is a practical, step by step guide loaded with tones of analyses, tricks, hints that will significantly improve the speed with which you do the analyses as well as the quality of the conclusions coming out of available in your company data. There is little theory – mainly examples, a lot of tips from my own experience as well as other notable examples worth mentioning. Our intention is that thanks to the course you will know:

What is the difference between business models and financial models?

How to model cost positions and balance sheet position?

How to create on the basis of this financial statements: profit and loss statement, balance sheet statement and cash flow statements

How to make sure that there is integrity in the model?

What analyses and conclusions you can draw from the financial model?

You can also ask me any question either through the discussion mode or by messaging me directly.

How the course is organized?

The course is divided currently in 10 sections and will be adding new section to address other important issues. Currently you will find the following sections:

Introduction. We begin with little intro into the course

Modeling of Profit & Loss account. In this section we start by showing how to model cost positions (except for Depreciation)and how to create on the basis of this a profit & loss statement

Capex and Depreciation. Capex and Depreciation are one of the most difficult elements that you will model in Excel. Therefore, we have created a separate section devoted just to this subject . In this section you will learn how to follow specific group of assets, truck their gross and net value and calculate depreciation.

Working Capital. Working capital is crucial to the business as it defines how much money you have to have engaged in the business. I will show you how to model specific positions of Working Capital

Debt. You may need external sources of financing for the company. I will show you how to model loans and get the necessary info to create balance sheet later.

Equity. In this section I will show you how to model the equity and all relations with shareholders

Balance sheet modeling. Here we get everything together to model the balance sheet statement.

Cash flow modeling. Here we get everything together to model the cash flow statement. Here we will check integrity of the model as well.

Analyses of the Financial Model. At the end, on the basis of ready model I will try to draw the conclusions that will show us whether the business we have been analyzing is interesting or not

You will be able also to download many additional resources

Excels with analyses shown in the course

Links to additional presentations and movies

Links to books worth reading

DJordanMedia The Complete Editing Course Bundle Pack

2025-11-11 23:09:34

Luke Stackpoole – Photography Masterclass – Master The Art Of Photography

2025-11-11 18:14:10

77组电影外观Log/Rec709视频还原色彩分级调色Lut预设包Pixflow – Colorify Cinematic LUTs

2025-02-13 11:03:14

复古怀旧电影风格温暖色调索尼Sony S-Log3视频调色LUT预设ROMAN HENSE – LUTs 24 for Sony S-Log3

2025-02-13 11:01:09

JUAN MELARA – P6K2Alexa PowerGrade AND LUTs V2 GEN 5

2025-02-13 10:58:24

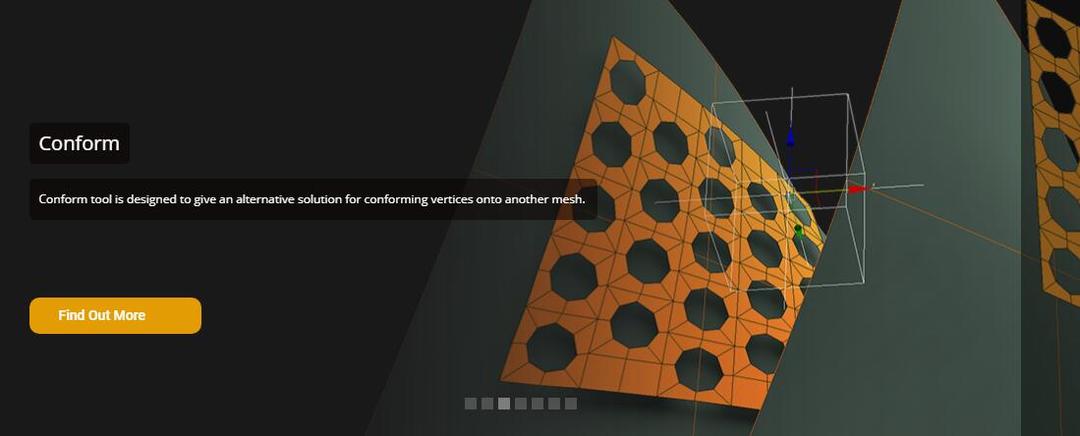

3DsMax建模插件集合:rapidTools v1.14+使用教程

2020-07-06 17:44:38

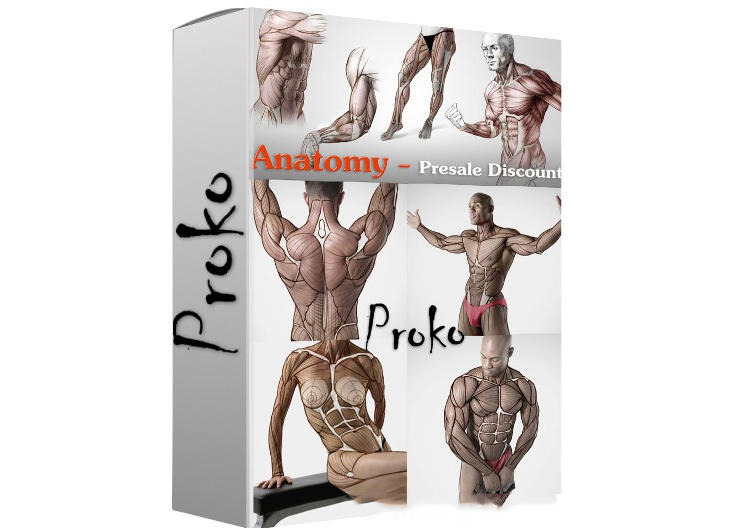

Proko-人体解剖高级付费版(中文字幕)256课

2020-12-21 18:34:01

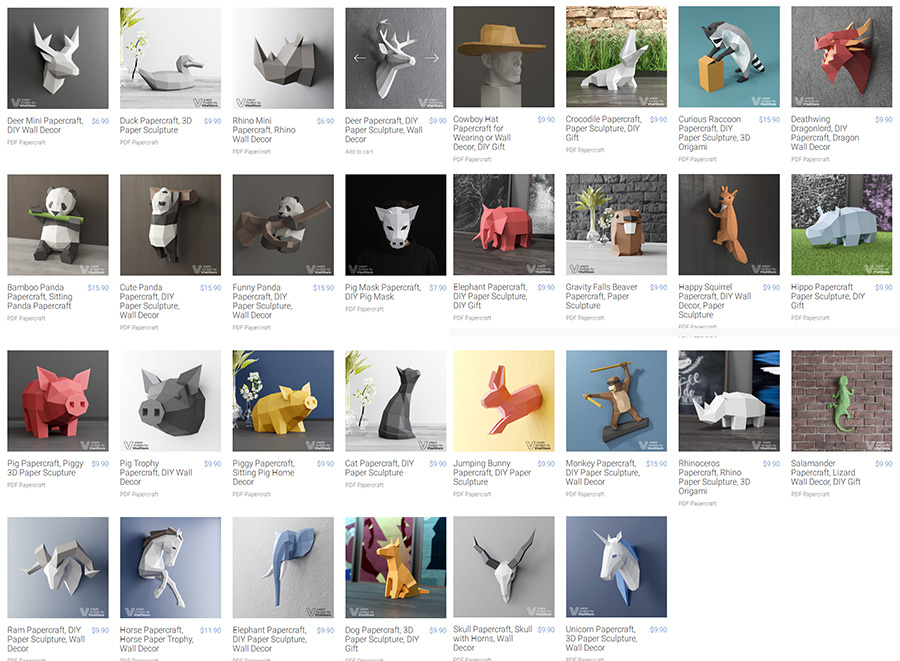

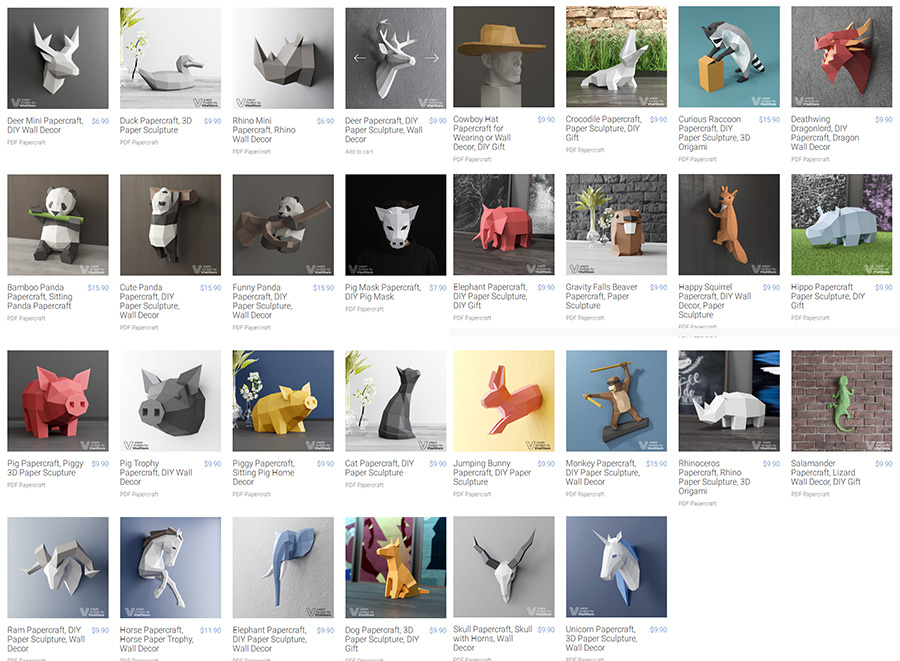

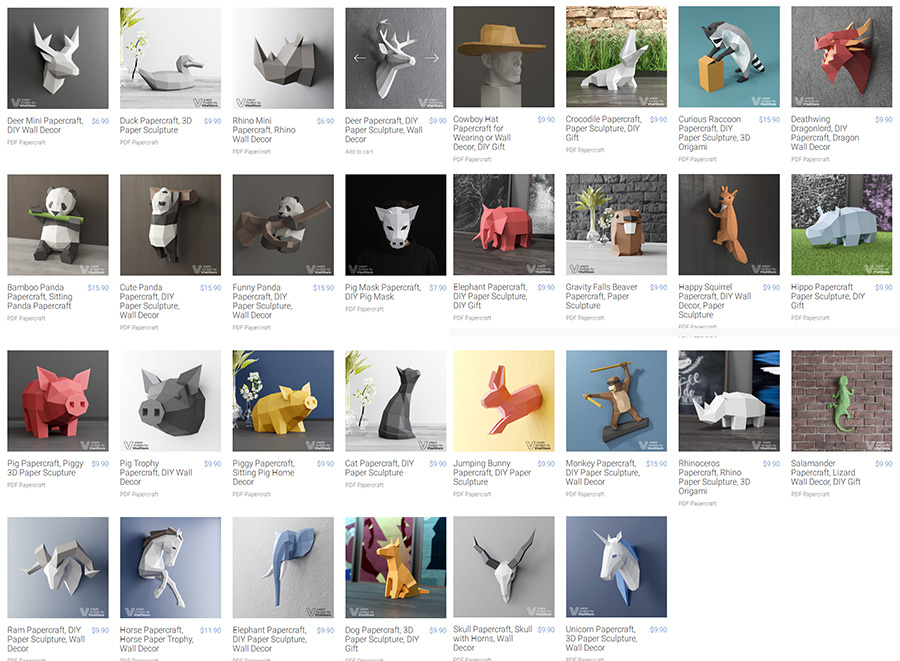

VitaliStore - All Design Bundle Papercraft Sculptures Design 动物纸模模型 纸模型雕塑设计

2020-07-21 17:18:14

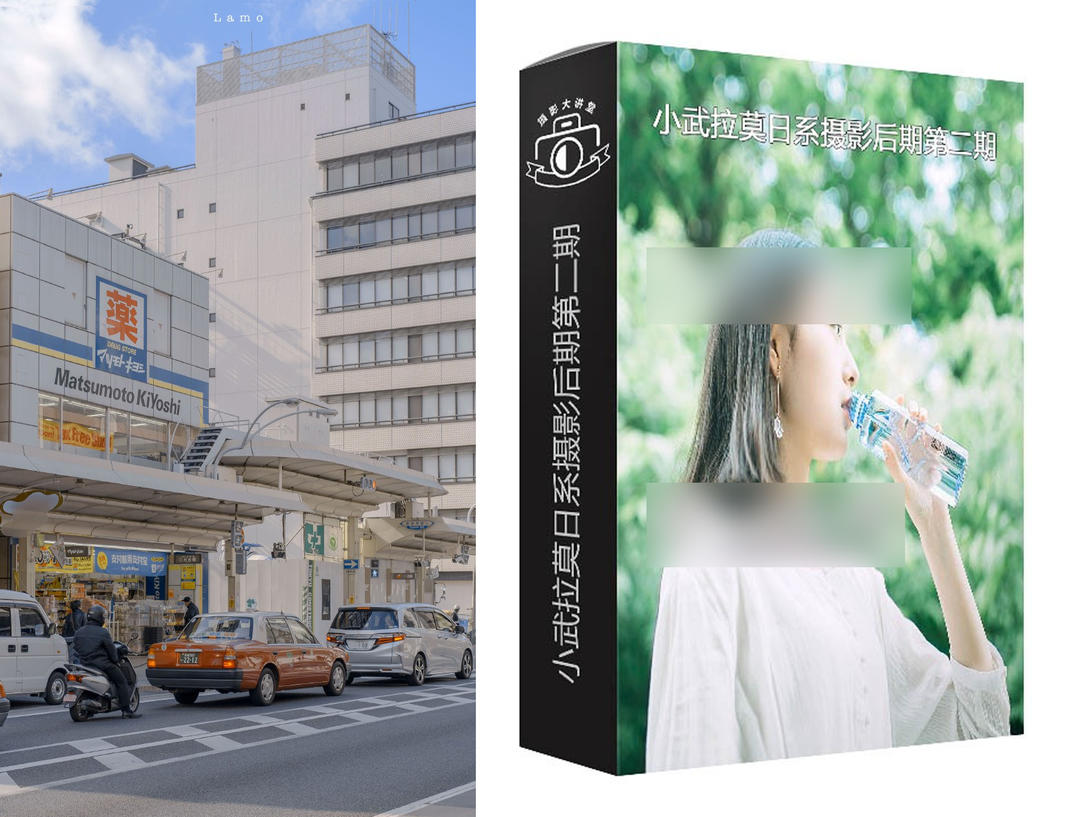

小武拉莫日系摄影后期第二期中文视频教程

2021-12-10 14:26:14

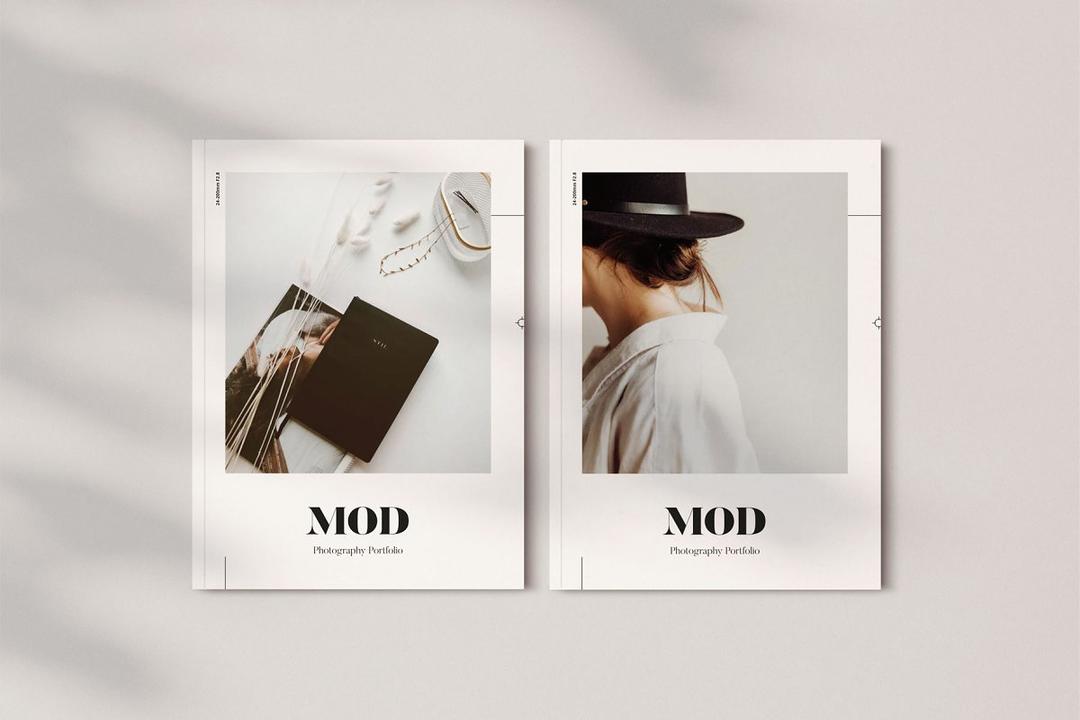

Mod Portfolio 3477506 画册模板 时尚杂志画册模版

2020-07-13 10:43:06

小武拉莫日系摄影后期第二期中文视频教程

2021-12-10 14:26:14

VitaliStore - All Design Bundle Papercraft Sculptures Design 动物纸模模型 纸模型雕塑设计

2020-07-21 17:18:14

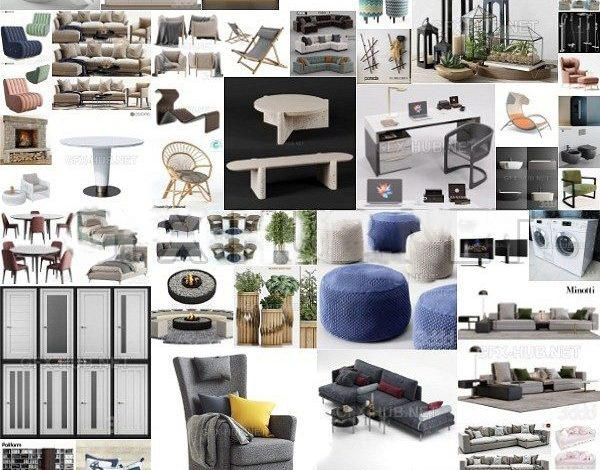

3DDD 3DSky PRO models – April 2021

2021-08-09 17:15:13

MasterClass 大师班课程84套合集+中文字幕+持续更新+赠品会员

2021-01-26 16:03:27

加特林机枪模型 加特林机关枪 Minigun Hi-Poly

2019-07-31 11:06:07

评论(0)